Article

Article

Impact bonds are outcomes-based contracts that catalyse funding from “risk investors” to cover upfront working capital to deliver services. To improve the quality of education available for children in India, a goal aligned with the U.N.’s Sustainable Development Goals, the Quality Education India Development Impact Bond was formed.

Impact bonds are outcomes-based contracts that catalyse funding from “risk investors” to cover upfront working capital to deliver services. To improve the quality of education available for children in India, a goal aligned with the U.N.’s Sustainable Development Goals, the Quality Education India Development Impact Bond was formed.

Insights from

Written by

Financing Quality Education

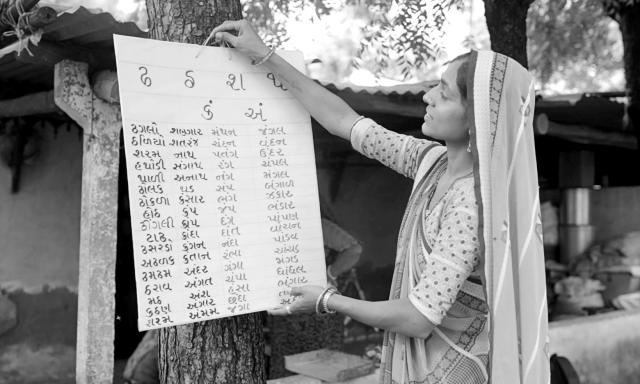

India has made enormous progress in education to achieve a 99 percent rate of primary school access, but what of the quality of education available for children in India? In 2018, India’s annual ASER survey indicated that the average Grade V student in India is at least two years behind in grade-appropriate learning. This has been further exacerbated by the impact of the COVID-19 pandemic and resulting school closures.

In alignment with the United Nations’ Sustainable Development Goals’ focused attention on improving the quality of education (SDG 4) to ensure that children in school are actually learning, the British Asian Trust (BAT), UBS Optimus Foundation (UBSOF), Michael & Susan Dell Foundation (MSDF) and others came together to launch the Quality Education India Development Impact Bond (QEI DIB) in 2018.

The initiative was a pioneering collaboration between leaders from across private and philanthropic sectors to scale up proven interventions to improve learning outcomes of students, as well as address the critical gap in financing by unlocking new funding and making existing funding work better.

Quality Education India Development Impact Bond (QEI DIB)

At $11 million, QEI DIB was the world’s largest development impact bond in education.

Impact bonds are outcomes-based contracts that catalyze funding from “risk investors” to cover upfront working capital required for service delivery. The service is designed to achieve measurable predetermined outcomes, and the investor is repaid by “outcome funders” if these outcomes are achieved.

QEI DIB was set up with three key objectives:

Improve literacy and numeracy skills for 200,000 students by funding learning outcomes, doing so by supporting four diverse intervention models:

Show that outcomes-based financing delivers value for money and drives efficient spending.

Demonstrate the benefits of outcomes-based financing to drive innovation in the global education sector and transform the traditional approach to grant-making and philanthropy.

QEI DIB adopted the following principles to achieve its objectives:

The following objectives were achieved at the end of the four-year program:

In the long term, QEI DIB built a strong body of evidence around what works and what does not in outcomes-based financing. The learnings have activated new funding and paved the way for a more mature and dynamic outcomes-based financing market.

Accountability is the new black. One need look no further than “woke capitalism” critiques levied against ESG efforts to understand the importance of accountability for business and society strategies. During an era of distrust about the capacity of business to make our world better, efforts are seemingly ubiquitous among development finance scholars and practitioners to increase accountability: to better measure, manage and report their impact to stakeholders — and to ward off naysayers in the meantime.

Perhaps nowhere in sustainable finance can one find the “proof in the pudding” more than in outcomes-based interventions such as development impact bonds (DIBs). DIBs, social impact bonds and environmental impact bonds have proliferated in recent years to offer pay-for-performance solutions to persistent economic, social and environmental challenges. For example, Washington, D.C., was one of the first U.S. cities to issue an environmental impact bond to finance the construction of green stormwater runoff. In another project, the World Bank issued a sustainable development “Rhino Bond” to protect the habitat of the endangered black rhino in South Africa. These public-private partnerships fuse accountability with scalability by combining the financial might of commercial institutions with the contextual and topical expertise of impact-oriented organizations.

By predefining outcomes and tagging financial success — and payouts to investors — to the achievement of those outcomes, public-private partnerships use the pay-for-performance model to demonstrate the efficacy of social interventions, doing so while scaling those interventions within populations who desperately need them. The Quality Education India Development Impact Bond is a prime example of how innovative collaborations between business, governmental and nongovernmental partners can create — and be held accountable to — impact for beneficiaries while being economically self-sustaining.

The Darden School of Business’ Institute for Business in Society partners with Concordia and the U.S. Department of State Secretary’s Office of Global Partnerships to present the annual P3 Impact Award, which recognizes leading public-private partnerships that improve communities around the world. This year’s award will be presented at the Concordia Annual Summit the week of 18 September 2023. The five finalists will be highlighted on Darden Ideas to Action on Fridays leading up to the event.

This article was developed with the support of Darden’s Institute for Business in Society, at which Maggie Morse is director of programs.

Kaufmann teaches business ethics in Darden’s full-time and part-time MBA formats. She uses normative and empirical methods in her research on business ethics, including in the areas of social and environmental impact, impact investing and gender. Her work has been published in Business Ethics Quarterly and Academy of Management Review.

Prior to joining Darden, Kaufmann completed her Ph.D. in applied economics and managerial science at The Wharton School, where she was recognized as the inaugural doctoral fellow at the Wharton Social Impact Initiative and as an emerging scholar by the Society for Business Ethics.

In addition to her appointment at Darden, she is an affiliated faculty member in the Women, Gender & Sexuality Department at UVA.

B.A., University of Pennsylvania; M.Sc., London School of Economics and Political Science; Ph.D., University of Pennsylvania Wharton School

Outcomes-Based Financing: The Quality Education India Development Impact Bond