Article

Article

A new study of Nigeria’s top banks finds that having more women on boards doesn’t hurt financial performance. In fact, gender-diverse boards perform just as well as male-dominated ones — debunking the myth that diversity comes at a cost.

A new study of Nigeria’s top banks finds that having more women on boards doesn’t hurt financial performance. In fact, gender-diverse boards perform just as well as male-dominated ones — debunking the myth that diversity comes at a cost.

The recent push for greater gender diversity on corporate boards has sparked debate — some say it improves performance, others warn it trades profits for social goals. So, which is it? During my second year at the University of Virginia Darden School of Business, I explored that question through the lens of Nigeria’s banking sector.

Nigeria Presents a Unique Case

As one of Africa’s largest emerging markets, Nigeria has a well-established banking sector that plays a critical role in national economic development. Notably, women have made gains in executive leadership: nearly 30% of top commercial banks — including Zenith Bank, GT Bank, First City Monument Bank (FCMB) and Fidelity Bank — are currently led by female CEOs or managing directors.

However, gender balance at the board level is inconsistent. Women hold, on average, just 26.3% of board seats, with some banks reporting as low as 6.7%. This gap between the progress at the executive level and the underrepresentation on boards raises an important question: does gender diversity in the boardroom impact financial results?

What I Found: No Performance Penalty

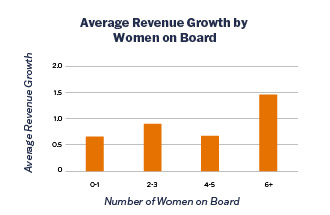

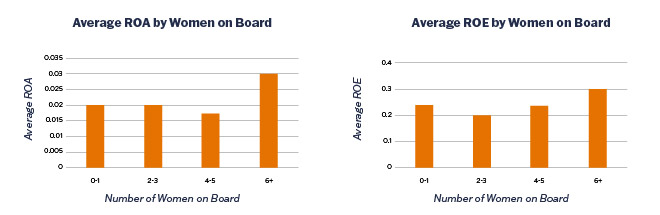

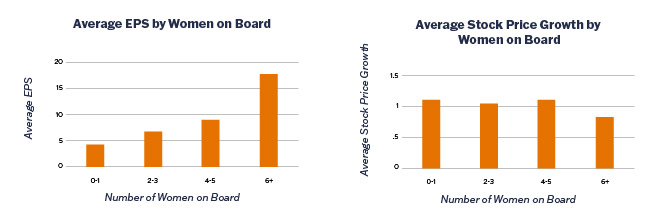

I analyzed all 13 publicly listed Nigerian commercial banks and compared their 2022 board composition with financial results in the following year to explore possible correlations. Across five key performance metrics — return on assets (ROA), return on equity (ROE), earnings per share (EPS), revenue growth, and stock price growth — I found no significant link between board gender diversity and financial performance.

This was consistent regardless of how gender diversity was measured — whether by number of women or proportion of women — and even after controlling for factors such as board size, board meeting frequency and firm assets.

The takeaway: In Nigeria's banking sector, companies with gender diverse boards perform just as well as those with majority-male boards. While I did not find evidence that diversity drives immediate financial outperformance, it does not appear to hurt a company's bottom line.

Beyond the Balance Sheet

Financial performance captures only one dimension of a board’s impact. The findings from this study highlight that executives should view board diversity as a broader strategic asset rather than merely a means to attain short-term financial benefits. For example, gender-diverse boards may help strengthen risk management practices, improve company transparency, support more balanced decision-making and provide fresh perspectives on strategic challenges.

While these second-order benefits may not show up immediately in financial results, they can influence critical factors that affect performance. For example, stronger risk oversight driven by diverse viewpoints could lead to fewer bank loan defaults and, ultimately, improved ROA. In Nigeria’s volatile business environment, these capabilities matter.

What This Means for Business Leaders

For executives and directors, here are the takeaways:

1. Do not fear performance trade-offs: Including qualified women on your board does not compromise financial results.

2. Think long term: The value of diverse leadership may emerge through improved decision-making processes and risk management rather than immediate financial returns.

3. Context matters: How diversity creates value may depend on your specific market environment.

My research supports the case for gender-inclusive boards — not because they guarantee superior financial returns, but because they allow firms to pursue broader business goals without compromising performance.

As the banking industry continues to evolve in Africa's largest economy, boards with diverse perspectives may be better positioned to tackle complex challenges and seize opportunities. While this analysis focused on only Nigeria's banking sector over a specific one-year timeframe, it offers a valuable perspective in the global conversation about governance best practices in emerging markets — where most of the world's economic growth will happen in the coming decades.

This article is based on research conducted by Chinelo Nwangwu (MBA ’25) as part of an independent study overseen by Yo-Jud Cheng, assistant professor of business administration in the Strategy, Ethics and Entrepreneurship area at Darden.

Cheng’s research focuses on corporate governance and top management teams. To learn more about how her dedication to research not only shapes her teaching but also transforms her students’ understanding of the business world, see the feature — "Uniting Research and Teaching: The Case for Faculty Excellence" — at the Darden Report.