Beyond Strategy: 3 Lessons and 4 Ingredients of Execution

A couple of years ago, during a strategic review process at SunTrust, our analysis of the banking financial services industry revealed something very interesting: Strategy alone did not differentiate high- from low-performing firms. The true differentiator between winners and losers turned out to be how well the strategy was executed.

The data on this were fairly compelling, and it turns out the trend extends beyond banking. A recent Conference Board CEO Survey identified execution capability as the critical challenge facing today’s business leaders. No one seems to disagree on the importance of execution, but a study by Bain & Company found that only about 15 percent of companies truly have what we might call “high-performance organizations” (62 percent are rated merely adequate, and a surprising 23 percent actually have organizations that hold them back). John Kotter (2012), an expert on organizational transformation, reinforced this concern, noting that 70 percent of all strategic initiatives fail because of poor execution. Only 37 percent of companies report that they are very good when it comes to execution (HBR survey, 2010). Add it all up, and the conclusion seems to be glaringly obvious: (1) Execution is important both strategically and operationally, (2) many of us, regardless of industry sector, need to get better at it and (3) it is a leading cause for concern among CEOs.

Three Lessons About Execution

Over the past few years, we’ve been on a journey to focus on execution capability. And we’ve learned three important lessons along the way. First, although most everyone seems to agree that execution is critical, there is far less agreement on what is required to achieve it. Former Honeywell CEO Larry Bossidy noted in his book Execution that people believe they understand execution — “it’s about getting things done” — but when asked how they get things done, “the dialogue goes rapidly downhill” (Bossidy & Charan, 2002).

The second lesson we’ve learned is that moving from theory to practice can be just as challenging. One of our priorities for the project has been to identify a set of core metrics that allows us to assess a business unit’s execution capability. To be candid, our goal has never been to zero in on every isolated element that affects performance. There’s value in that approach, of course, but exhaustive measurement would likely lead to a cacophony of metrics that most CEOs would find unusable.

Third, we’ve learned that most metrics are primarily descriptive, much like a racecar’s dashboard — they provide useful information, but in and of themselves they may not prevent accidents, maneuver around obstacles, or propel the car forward. We have adopted the metaphor of a navigation/guidance system that helps us make the right decisions, improves responsiveness, and accelerates growth and profitability. Over the past few years, we’ve been able to frame more clearly what execution excellence entails, but more importantly, we’re learning what it requires.

THE 4A MODEL

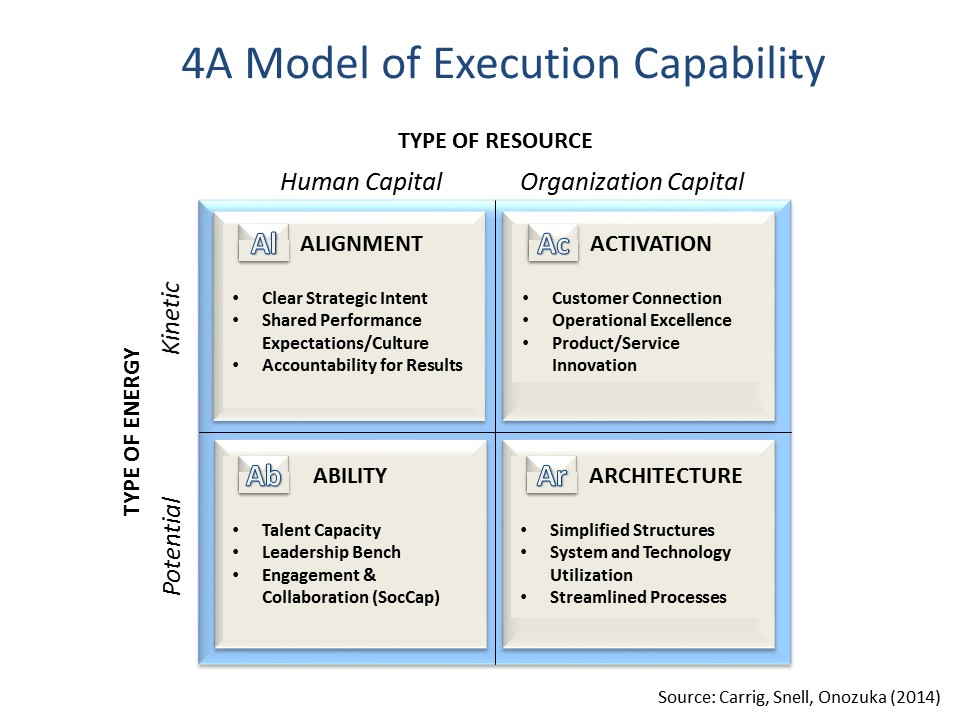

So where do we start? At the end of the day, the performance of organizations depends on building an architecture that supports the collective abilities of individuals aligned toward achieving strategic outcomes. There are many important elements underlying execution excellence, but we focus on four: alignment, ability, architecture and activation.

The 4A model is not composed of four independent factors — they are integrally related, interdependent and mutually causal. Bossidy and Charan argued that “execution is a discipline,” and we would not disagree. At the same time, we find it useful to think of execution capability more fundamentally as building the firm’s resource base to energize performance. As shown in Figure 1, this is a system that combines human capital and organizational capital and that generates both potential and kinetic energy.

Ironically, we often refer to people and organizations as “resources,” but less as sources of energy. In his work with senior executive teams, Jim Clawson (2012) emphasizes that “leadership is about managing energy, first in yourself and then in those around you.” The same logic applies to strategy execution. Executives need to build the “ability” and “architecture” factors as sources of potential energy — the human potential and organizational potential that determine the firm’s capacity to execute. At the same time, they need to foster “alignment” and “activation” as sources of kinetic energy — vitality that propels the firm into action. Alignment energizes performance by focusing and concentrating human resources. Activation energizes execution by channeling and accelerating it toward value-adding activities. Ask any leader with responsibility for strategy execution and he or she will tell you, “Resources are important; managing energy is essential.”

Alignment: Focusing Energy Toward Breakthrough Performance

The sine qua non of execution capability is alignment. Organizations only exist because people can achieve more together than on their own. Alignment provides coherence, focus, energy and resilience in the face of change. And, not surprisingly, lack of alignment is a key source of divergent interests, conflict, dispersion and decay.

Three underlying elements in our model focus on the cognitive, affective and operational aspects of alignment:

Clear Strategic Intent. The clarity with which firms’ strategy is devised, articulated, and communicated does make a difference. Two decades ago, Treacy and Wiersema (1995) described in their book, The Discipline of Market Leaders, that 75 percent of the executive teams they studied could not clearly articulate their value proposition. The same can probably be said today, and, without a shared purpose, strategic intent and articulated strategy, it is difficult to establish a focal point for collective action and performance.

Shared Performance Expectations and Culture. As the underlying foundation of the organization’s culture, shared expectations serve both as points of aspired behavior and guardrails for acceptable action. But in the context of execution, shared expectations have to be operationalized as concrete behaviors driving performance, or else they get lost in the sea of good intentions and soft ideas.

Accountability for Results. Many of those we work with assume that emphasis on accountability is a reaction to employee shirking. We think of the term more literally as “account” and “ability” combined. Without the ability to account for results toward a goal, it is difficult to create much focus for action or energize commitment toward it. Accountability requires establishing a set of performance metrics, feedback processes and shared outcomes (rewards) for performance.

Ability: Building Human Potential

People are an organization’s greatest asset (there, we’ve promulgated the cliché). But the truth is that many organizations have faltered while burgeoning with talented people. And, if we were brutally honest, we’d admit that organizations traditionally have worked to take people out of the production equation in order to improve execution, preferring to substitute technologies for humans. But in the contemporary setting, where knowledge is a vital ingredient for both efficiency and effectiveness, that would be a mistake.

We focus on three aspects of an organization’s human capital:

Talent Capacity. Like any capital investment, the “make or buy” decisions for talent require tough choices about where payoffs will be greatest. Because HR budgets are often the first to be cut in difficult times, fewer dollars means more scrutinized investment. The priority with regard to execution is generating more high performers, particularly in critical roles.

Leadership Bench. Leadership, beyond talent alone, often comes down to mobilizing excellence through others. Cultivating leaders requires longer lead times, of course, and therefore more enduring investment. As Wayne Gretzky, the great talent guru, said, “Skate to where the puck is going to be.”

Engagement and Collaboration. An organization’s ability to execute ultimately depends on more than the skills of individuals or human capital. It extends to the social capital as well, the value of relationships and collaboration that drive collective achievement.

Architecture: Designing Organizational Capability

The design of organizations makes a big difference in terms of reliability, scalability and continuity of performance. So in terms of strategy execution, the organizational architecture is critical for managing resource flows, information availability, decision-making and process.

We focus on three key aspects of the organization’s architecture:

Simplified Structures. Although the adage “structure follows strategy” probably still applies, in terms of execution capability, the key is to simplify structures to eliminate needless complexity. The two fundamental purposes for structure are: (1) Delineate lines of authority and decision rights, and (2) improve channels of coordination and communication.

Information System Access/Utilization. It may come as no surprise that knowledge management is viewed by executives as the most important source of potential productivity gains over the next 15 years (Economist Intelligence Unit, 2006). The role of information technology affects execution capability in three principal ways: (1) operational, (2) relational and (3) transformational.

Streamlined Processes. Technology investment without corresponding process redesign is like “paving cow paths.” A whole cottage industry has arisen around the principles of process improvement and execution. At a minimum, execution is improved when processes and standard work are clearly defined, process owners are known and accountable, and measurement systems are used as a basis for decision-making.

Activation: Channeling Value-Added Effort

Will Rogers, the famous humorist, used to quip, “Even if you’re on the right track, you’ll get run over if you just sit there.” The same is true of strategy execution. In contrast to the common conception of strategy implementation, whereby someone says “go,” world-class execution is nearly impossible to achieve from a standing start.

We focus on three forms of activation for strategy execution, each of which provides a more proximal indicator of firm performance:

Customer Connectivity. The connection to customers helps clarify priorities for execution. We first need to clarify how we intend to stake a claim in the marketplace, and then design the organization’s infrastructure and allocate resources to execute toward those ends.

Operational Excellence. In some ways, we might conclude that execution and operational excellence are synonymous. To some, the differences may only be semantic. In this context, we conceive of operational excellence more narrowly, as those activities driving internal efficiency.

Product/Service Innovation. Experts in the field of innovation make a distinction between two types of organizational learning: (1) exploration, which is going into new domains, and (2) exploitation, which is deeper learning within the current domain. Without developing deeper expertise in current product/service domains, a firm’s execution capability will stall.

The preceding is excerpted by Darden Professor and Senior Associate Dean for Executive Education Scott Snell, Kenneth Carrig and Aki Onozuka’s paper “In Search of Execution,” which will appear in the book View From the Top: Leveraging Human Capital to Create Value (Society for Human Resource Management). Please see its companion piece, “Beyond Strategy: 3 Steps Toward Execution,” which details steps leaders can take to improve their organizations’ strategy execution. Professor Snell is senior associate dean of Darden Executive Education.

The findings were presented at a CHRO Roundtable held in partnership with the Antai College of Economics & Management at Shanghai Jiao Tong University.

Companies that participated in the research include:

| Abbott | Ericsson | McDonald’s |

| Accenture | General Dynamics | McGraw-Hill Companies |

| Ally Financial | General Electric | McKesson |

| American Express | Gilead | Moody’s Corporation |

| BAE Systems | Hewlett Packard | Motorola |

| The Blackstone Group | Hyatt | Munich RE |

| BloominBrands | IBM | Newell Rubbermaid |

| Boeing | Intel | Northern Trust |

| Broadridge Financial | ITW | Pfizer |

| Carter’s | Kaiser Permanente | Safe-Guard Products |

| CDW | Laureate | Sears |

| Citi | SunTrust | |

| Coca-Cola | Lockeed Martin | Symantec |

| Coca-Cola Enterprises | Marriott | U.S. Army |

| Delta Airlines | Marriott Vacations | Workday |

| Equifax | Maximus |